Performance

Fowler Drew goal-based, outcomes-driven portfolios are fully customised based on the outcomes planned, as real amounts within specific tolerances at defined dates.

Risk is managed by separating the portfolio by risky and risk free assets where the latter are matched to the duration of the cash flows or capital sums required as outcome. We do not publish any composite performance data for these outcomes-driven portfolios, as most of the return contribution stems from how the client defined the outcomes and their required certainty. See Whose performance is it anyway?

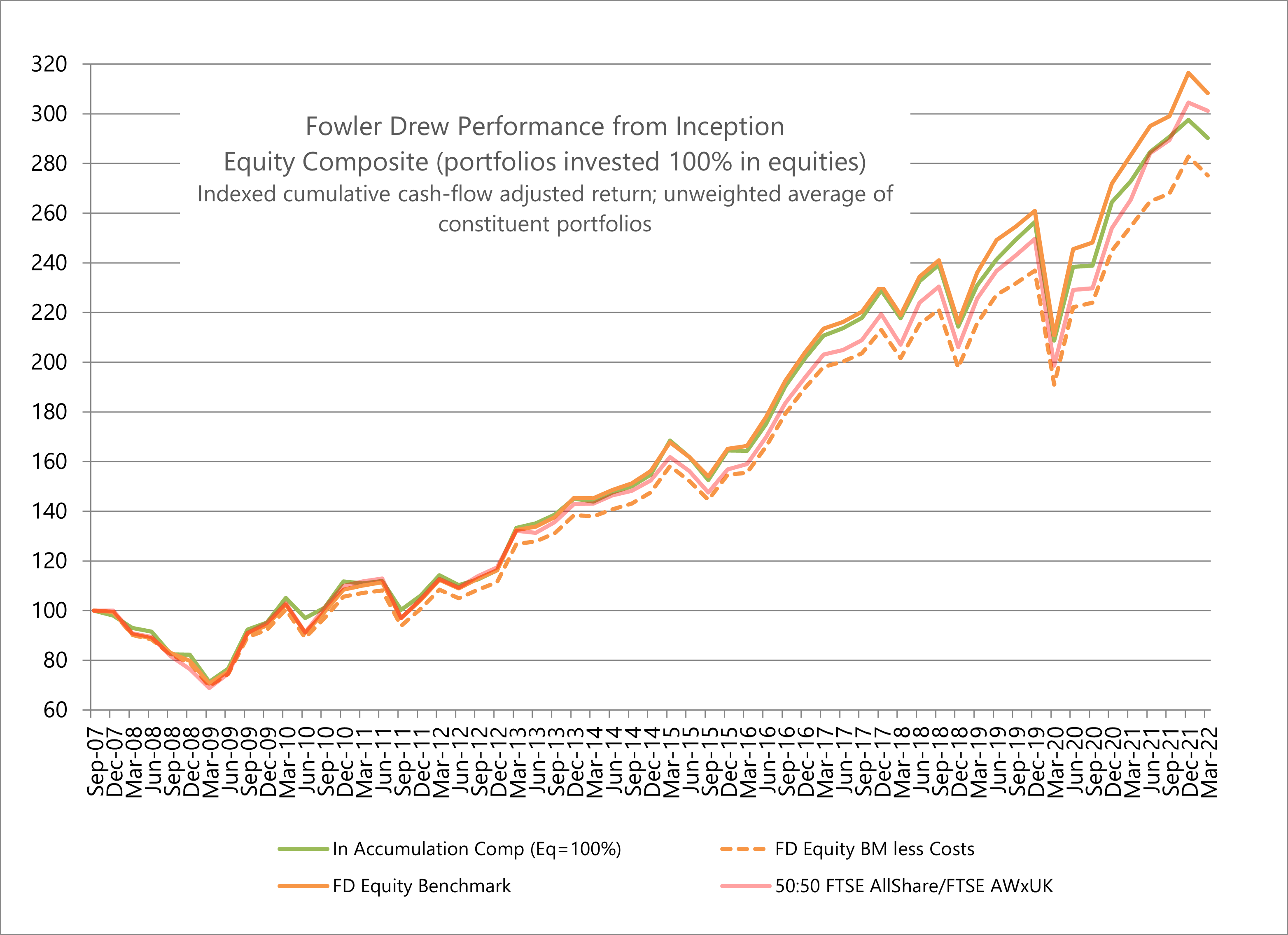

The risky-asset component is broadly common to all. Performance of the risky-portfolio component is measured as a composite of all goal-based portfolios invested 100% in equities. This we do publish.

Equity Composite since inception

Notes

- The Fowler Drew Equity Composite is an unweighted average of all portfolios invested 100% in equities (that is typically in accumulation or intergenerational). The only exclusions are portfolios with significant positions in legacy, non-model assets.

- Returns are adjusted for cash flows into or out of the portfolio.

- The FD Equity Benchmark takes its weights from a portfolio optimisation run in which all markets are in line with their own historical real total return trend, risk is as observed historically and real risk free rates are assumed to be a theoretical constant 1%. Actual performance against this ‘normal’ benchmark measures the performance effect of optimising the portfolio instead on the basis of our observed deviations from ‘normal’.

- The FD Equity Benchmark cost-adjusted allows for transaction costs and return effects when rebalancing to the fixed weights in the composite (actual portfolios cannot rebalance to fixed weights without incurring costs and without a performance effect compared with indices whose weights are allowed to ‘drift’).

- The benchmark for comparison is a composite of 50% FTSE All Share Index and 50% FTSE All World ex UK (with no cost adjustment). This is chosen to be reasonably representative of equity exposures in private wealth management. There is no adjustment for costs as more of the weights are allowed to drift.