Investors could be forgiven for thinking that the pace of technology disruption is increasing and that it threatens both the current constituents of equity market indices and the core trend of equity real returns. We disagree.

The lesson we chose to draw from long historic returns for global markets is that the equity return process is remarkably adaptive. It pays to bet on it continuing to adapt.

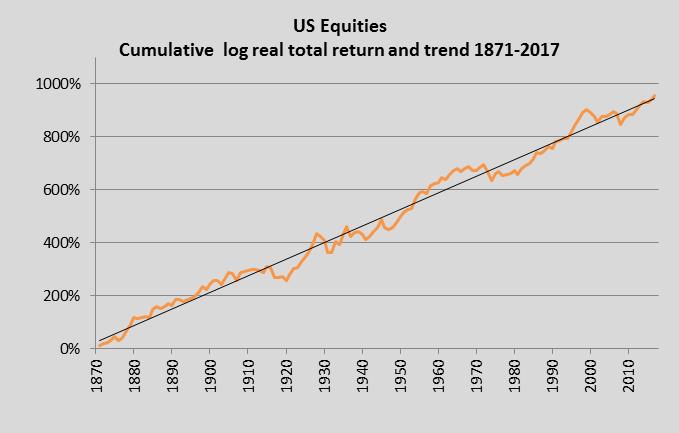

The chart shows a long historical time series for returns from US equities – for most of its history this is the familiar S&P 500 Index. It plots, as an index, the cumulative real total returns (i.e. capital gain plus income reinvested) in log terms (keeping changes proportional). The regression trend fitted to the historical path of returns has a trend growth rate of 6.2%. This compares with a band for other equity markets (for periods ranging from nearly 50 years to over a century) of 4.8% for Japan (possibly too short to be representative) and a much closer bunching for the UK, Europe ex UK, Australia and Emerging Markets of 6.0-6.6% pa. What is striking about the long history in the chart is the changing nature of the economy in which these returns were earned. In the early part of the data the US was a fast-growing emerging economy, with nothing like the economic power of the years to come, between the wars; and that absolute and relative power is in turn now dissipating. Though these shifts in the type of economy show up in changes in GDP growth rates, they clearly do not show up in the return on a representative index of US public companies.

They do show up, though, in the companies making up the index. These have changed enormously between these three stages. Steam traction led to a market dominated by railroad stocks. Oil introduced auto makers. But in just two decades time lithium ion or solid state batteries may well have killed off the internal combustion engine completely. Local electricity storage would massively shrink the share of markets accounted for by power utilities. And the biggest change of all, now that solar energy without subsidy is already competitive with high-cost fossil fuels, is the replacement of extractive companies and utilities by solar disruptors. Even banking, still a large part of most indices, is at risk of being disrupted (but not by resource-intensive blockchain technology). Youtube is the place to go to watch serious, authoritative presentations about ‘technology disruption’.

The pace of disruption does appear to many observers to be accelerating. This is not typically because cost curves are falling even faster but rather that so many fast-falling cost curves are now crossing thresholds where disruption is economically inevitable. For instance, driverless cars are enabled by both computing and solar cost curves as well as battery technology developments.

With the changing composition of the economy, conventional measures of output such as GDP and productivity growth already call to be replaced. They are not able to capture the real factors driving business performance and wealth creation. Through it all, history should remind us that the one thing that may not change is the trend return of a dynamic index of the (then) largest listed companies. However ‘naïve’, extrapolation remains the best basis for estimating probable long-term returns.

An even greater economic change is possible: the end of scarcity. In this story, capital and raw materials cease to constrain growth or dictate labour requirements, as nanotechnology allows us to create everything we need from atoms and molecules in micro-factories in our own homes. Since that could change everything about our social structures, it is highly likely to make the model of wealth creation defined here completely redundant – and destroy our model with it. And it is not beyond the horizons of many of our clients’ goals, if it is realistic in say 50 years and discounted in share prices in even less. Fear not, however. The end of scarcity means the problem we are trying to solve, funding future consumption goals given limited financial resources, itself disappears.